Introduction

Money. So much more the investors can do with it. The purpose of this article is to investigate the latest opportunities in harnessing the power of cash in portfolio. We want to evaluate alternative roles of cash in order to fight inflation and cash-drag effects. Moreover, we’ll analyze how to diversify cash in different currencies minimizing risk and examining how they are correlated to each other. Finally, we’ll add some earning occasions in a modern approach to portfolio allocation and investment strategy.

Table of Contents

- Introduction

- The traditional asset allocation models

- Foreign exchange markets when cash is trash

- Stablecoins

- Yield opportunities when cash is king

- Conclusions

- Bibliography

The traditional asset allocation models

Looking at the way assets are mixed in a portfolio, we can gather several pieces of information such as the investor’s risk aversion, his beliefs, how far along he is in the time-frame journey and some other guesswork.

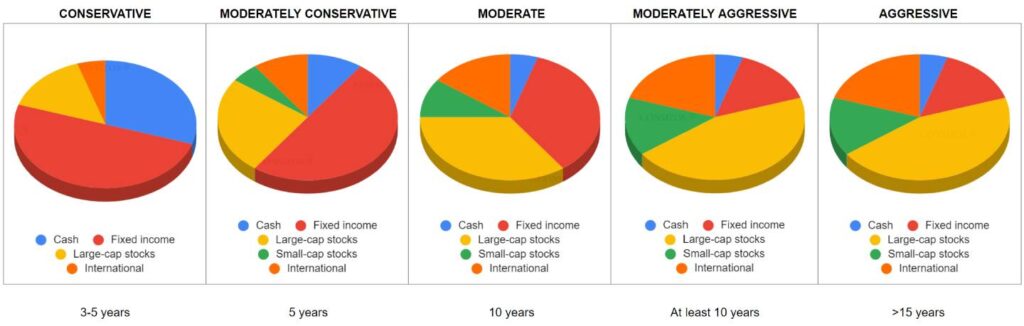

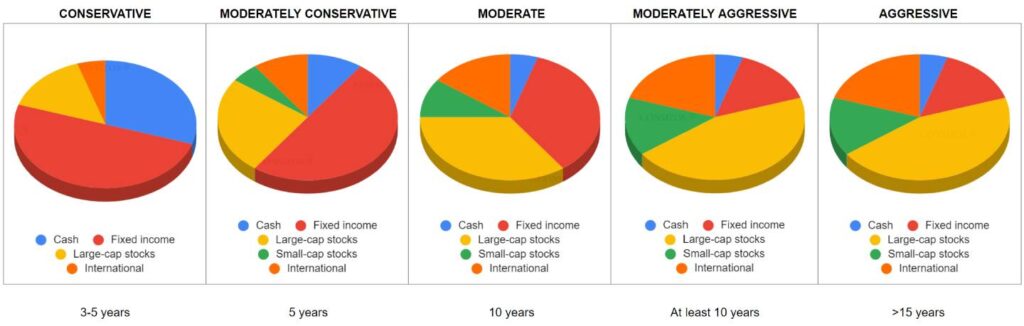

Although Modern Portfolio Theory (MPT) is well-known, the single portfolio is often personal and will be always affected by subjectivity, as an unavoidable human being feature. However, the common sense strategy is based on the following five asset allocation models according to the investor’s approaches:

Moreover, there are two main assumptions according to how the time-frame varies:

- The longer the time horizon, the greater will be the percentage of assets with an high risk/return profile (e.g. stocks);

- The closer the time horizon goal, the less will be the asset mix average risk.

The clever reader will notice the simplification degree of this schema: is it really possible to follow a few preset rules in order to optimize and rebalance a portfolio over time? As already discussed, there are a number of heuristics that affect our decision making process (and this is one of ’em).

First of all, the investor is expected to be risk tolerant towards short run volatility (in particular about bear markets). Moreover, there are tax implications that enable new mixes, because the after tax situation could be better than a standard allocation. Also, external agents (e.g. central banks), could apply unexpected policies that make one rebalancing more convenient than another.

What percentage of your portfolio should be in cash?

Staying on the subject of myth busting, when it comes to cash there is the custom to allocate around 3-5-10% in cash and cash equivalents. Actually, this is an arbitrary percentage: not too much because of inflation and other cash-drag effects, not too little in case the investor needs a liquid fund to be immediately used.

In this sense, we can easily realize that there isn’t a one-size-fits-all answer about how much cash should we keep in our portfolios, it depends on:

- Which time frame/phase we’re going through;

- The flexibility level of the allocation’s weights and rebalancing precision;

- Inflation rate and semi-cash risk free alternatives;

- Taxation;

- Non-cash assets dimension/weight.

Furthermore, someone suggests to allocate from 6 to 9 months living expenses in case of involuntary unemployment. It's a great idea, however they are mixing up the cash savings accounts with the brokerage accounts: here, we're talking about (portfolio) investments. An emergency fund is not inherently an investment.

Foreign exchange markets when cash is trash

Let’s focus on the cash & cash equivalent portion of the portfolio.

Picking assets and deciding their weights can be done in a number of ways and correlation between them is one crucial variable. In particular, the Spillover Index and the Frequency Connectedness can help us in determining the asymmetry measure related to the assets in the basket.

In this sense, the forex market could represent an interesting opportunity, mostly when we consider “trash” the cash allocated. Just to be clear, we’re neither looking for hedging (futures, currency options, forwards, currency swaps etc. are intended for it), nor for forex trading. We want to keep liquidity on hand, but our goal is to balance the cash-drag effect out (since cash doesn’t produce any yield).

Nevertheless, the modern approach to portfolio allocation encourages flexibility and dynamism, and this is so right if we look at the current period, full of market crash, bull run, negative-yielding bonds and so on. If in the past it was sufficient to believe in the long-term power, today someone is re-thinking about market timing in order to enter and exit out of the market when it seems convenient.

Today, it’s easier to diversify the cash allocation in strong currencies, digital currencies and foreign moneys. This can maintain a high flexibility in terms of liquid currencies but we can also benefit from a high-level portfolio diversification (Qarni, Muhammad Owais; Gulzar, Saiqb, 2021). This alternative role of cash in a portfolio results in a booster in risk optimization.

Thus, the basic idea is to split the cash in portfolio modifying the (mono)currency exposure in several currencies that react differently.

Correlation, spillover index and frequency connectedness

Our goal is basically to find the right currencies to be allocated according to the time frame we’re going through.

What assets should we consider for inclusion in a portfolio?

In mean-variance land, we are well versed in this framework: we want to add assets with high returns and low volatility and/or assets that help lower portfolio volatility by being good diversifiers (David M. Berns, 2020).

With special reference to foreign currencies, this can be done investigating asymmetry and correlation. An interesting example is the multivariate time-series analysis approach as proposed by Diebold and Yilmaz (Diebold, F.X., Yilmaz, K., 2014).

Having knowledge of the interdependence relationships among financial markets and determining the degree of spillovers is useful for government authorities and both financial and nonfinancial firms to diversify their portfolios, hedge their strategies, and manage their risks (Yuki Toyoshima and Shigeyuki Hamori, 2018).

The analysis can be conducted in Python or with SAS, SPSS, Matlab and similar Data Science softwares. However, there are apps and websites (e.g. cryptowat.ch), that allow to perform a simplified version of the analysis for those who lack statistical correlation knowledge.

In this context, our concern is to find currencies that are negatively correlated to the main currency of the portfolio or even uncorrelated of each other. Because of Dollarization, the main currency is often U.S. Dollar: so we’ll try to find something that helps the $ currency exposure, mostly when there are $ drawdown recoveries. In a Dollar-centric system, U.S. still exports its inflation (remember Bretton Woods II) and in addition, in case of the Strong Dollar, foreign portfolio revenues are going to translate into fewer dollars.

However, although these tools seem to be robust in a math sense, they could be quite tricky. Without getting too specific in the stochastic world, the investor has to bear in mind that covariance-based methods could make no sense due to the instability of single variances and the effect of multiplication of the values of random variables (Taleb, 2020).

Taleb himself says:

“Practically any paper in economics using covariance matrices is suspicious.”

Stablecoins

In order to give the cash an alternative role in portfolio, it’s possible to diversify it into negatively correlated and uncorrelated currencies. Stable coins represent a fast and cheap way to do it.

A stable-coin is a cryptocurrency pegged to another asset.

When it comes to currencies, it’s basically a tokenized fiat.

Here, we’re referring to cryptos whose prices are pegged to real-world fiat currencies. Better, backed 1:1 by the fiat they are pegged to (see the lessons learnt from the UST/LUNA crash). For instance, USDT, USDC, BUSD are all stable coins $ pegged.

This innovation is crucial for the cash diversification goal: we can easily sell or buy Australian Dollars, Canadian Dollars, Euro, British Pounds, Swiss Franc and so on.

Tokenized or not, Modern Portfolio Theory (MPT) says that by mixing asset classes with low correlation to one another in the appropriate proportions, risk can be reduced at the portfolio level, despite the presence of volatile underlying securities.

There is even a digital token backed by physical gold called PAXG: each token is backed by one fine troy ounce (t oz) of a 400 oz London Good Delivery gold bar, stored in Brink’s vaults. If you own PAXG, you own the underlying physical gold, held in custody by Paxos Trust Company (https://paxos.com, 2022).

Moreover, since stablecoins can be traded in a number of markets (and so exchanges), they can also protect the other portfolio assets in three main ways: stop-loss, hedging and harvesting. And hedging is quite crucial because hedged funds or ETFs are often expensive.

Yield opportunities when cash is king

For open-minded investors, there is an interesting additional way to harness the power of cash: cash staking.

The staking investment allows both to reduce the drag-effect and to earn a (passive) income at the same time. Someone talks about interest but technically it’s not an interest since it’s often not guaranteed and the investor balance is neither a bank account nor insured.

Top exchanges such as FTX, Nexo or Binance allow us to earn yield on the fiat balances ($, €, £, ¥, ₣ and so on), tokenized or not. There are staking rewards up to 8% A.P.Y. for those who think cash is king.

Obviously, staking carries some degree of risk as every investment. The issuer/platform risk for instance, DeFi correlated risks, devaluation risks.

The opportunity cost has to be considered too.

In light of this, we can surely affirm that this can be an interesting alternative in a lazy portfolio perspective or if the investor is looking for something to “earn while he sleeps”. Nevertheless, this use of cash is quite modern and thanks to digital currencies there are new opportunities in portfolio optimization that need to be further investigated.

Conclusions

We live in times when everything evolves and changes fast. Recently, the BOJ spent around 3.6 trillion Yen ($24.9 billion) in its first-dollar selling/yen-buying intervention in 24 years to stem the currency’s sharp weakening. Mexican Pesos and Brazilian Real rise up thanks to their import-export trend or simply their balance of trade. In this context, the investor should pay more attention even to the cash percentage in its portfolio (after building an emergency fund). Stablecoins can provide a buffer in the portfolio when the markets are volatile and some interesting earnings on deposit wallets.

Bibliography

DAVID M. BERNS, PhD (2020). Modern Asset Allocation for Wealth Management. John Wiley & Sons, Inc.: Hoboken, New Jersey

DIEBOLD, F.X., YILMAZ, K. (2014). Financial and Macroeconomic Connectedness: A Network Approach to Measurement and Monitoring, 1st ed.; Oxford University Press: Oxford, UK.

NASSIM NICHOLAS TALEB (2020). Statistical consequences of fat tails. Real World Preasymptotics, Epistemology, and Applications. Stem Academic Press.

QARNI, MUHAMMAD OWAIS; GULZAR, SAIQB (2021). Portfolio diversification benefits of alternative currency investment in Bitcoin and foreign exchange markets. Financial Innovation, ISSN 2199-4730, Springer, Heidelberg, Vol. 7, Iss. 1, pp. 1-37, https://doi.org/10.1186/s40854-021-00233-5

YUKI TOYOSHIMA, SHIGEYUKI HAMORI (2018). Measuring the Time-Frequency Dynamics of Return and Volatility Connectedness in Global Crude Oil Markets. Graduate School of Economics, Kobe University, Kobe 657-8501, Japan.